After financing the first phase of the project in just four days, we now present Altea II, the second phase of this fixed-rate opportunity with a first-rank mortgage guarantee that consists of financing the costs associated with the real estate development and construction of a building with 6 homes, 8 parkings and 8 storage rooms in Altea, Alicante (Spain). The developer supplies the land on the property.

Following the financing of the first phase, the construction work has progressed, with more than 30% of the work completed and the three remaining homes reserved, with all the homes in the project sold to date.

Once the incident with the excavation for the execution of the concrete wall trench in the northwest corner was solved, as well as the subsequent requirements requested by the City Council of Altea, which have caused a considerable delay in the execution of the project, the works have progressed and currently, 30.86% of the total planned has been completed.

The total built area of the development is 818,55 m2 and is distributed in:

Ground floor: garages, storage rooms and 1 dwelling:

First floor: 4 flats:

Second floor: 1. flat: 2 bedrooms, 2 bathrooms, living-dining room, kitchen, and large terrace.

Building located in the old town of Altea, 5 minutes from the beach. Next to the Parc de L'AIGUA and with all the necessary services: schools, universities, supermarkets, bars, restaurants, museums, churches, etc.

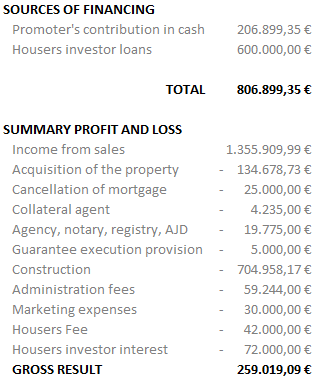

This loan of €150,000 corresponds to the second tranche of a €600,000 project.

The property to be taken as a mortgage guarantee is the property at Calle Costera Pont del Montcau No. 27, Altea, Alicante (Spain).

The investors entering this new tranche of the project will be novated to the mortgage guarantee already granted by the developer to the investors of the previous tranches, consolidating as a single first-degree mortgage guarantee for all the investors of the different tranches.

According to the valuation certificate issued by ARCO VALORACIONES S.A. on 17/05/2022, the current MORTGAGE VALUE/APPRAISATION of the property described amounts to the sum of 682.455,57€

Therefore, the valuation of the mortgaged property on the loan is 151,65% (Mortgage value €682.455,57 / Loan amount €450,000). The LTV (Loan to Value) of the project is 65.93% (loan amount €450,000/current appraised value €682.455,57). The estimated value of the property in the completed scenario according to the comparison method amounts to €1.312.998,31€.

The Guarantee Agent for this project will be Bondholders, a professional firm specializing in supplying independent agents and arranging services across asset classes and under numerous international jurisdictions. In recent years Bondholders has been mandated as agent and arranger in over 375 transactions being a total of close to €200 billion in debt. Its main clients include financial institutions, institutional clients, asset managers and sovereign government agencies. They are currently one of Europe's leading providers of independent fiduciary services.

The developer of the project is ALTEA I LAIGUA INMOBILIARIA S.L., a group of professionals with experience in different areas of the sector and with more than 45 years dedicated to the development of the Costa Blanca. They create avant-garde projects, adapting to the needs of the client. The developer group has a share capital of 31/12/2020 of 4.000€ and Equity at 30/09/2020 of 179.973,62€.

This is the second phase of the developer's first project in Housers. The developer may apply for other loans in the future through the platform to obtain funding for the implementation of other projects, within the legal limits and provided that their financial situation allows it. Thus, the degree of future leverage of the company may therefore be higher.

The monitoring company PROYECTOS CIGA will carry out the monitoring of this project, having permanent control of the destination of the capital provided by the investors and delivering this capital to the developer according to an agreed schedule after delivery of justification of compliance with certifications. To this end, the developer and the monitoring company will open an escrow account where the funds financed by the investors will be transferred in such a way that each provision to the developer must be justified to the monitoring company and therefore the full amount of the loan will not be delivered to the developer at once.

The project is in Altea, a municipality in the province of Alicante (Spain) in the Marina Alta region, between Benidorm and Calpe.

Highlights of the location:

Location

Housers will not charge any commission to the investor for this opportunity. Housers will charge the promoter a fee that will be determined based on a % of the funds raised by the promoter for the project, provided that the project is successfully funded. In case the project is not successfully funded, Housers will not charge this fee to the promoter. Once the project is financed and as a previous step to the delivery of the money to the promoter according to the disposition schedules, this commission will be deducted from the amount of the loan to be transferred to the promoter in favour of Housers, not affecting the final profitability obtained by the investors since it is the promoter who assumes its cost. In this opportunity Housers' commission is 8% + VAT being the commission financed within the opportunity.

Housers follows the law 5/2015 and is authorised by the CNMV as a Participatory Financing Platform registered under number 20.

Housers is not a credit institution or an investment services company. It is not a member of any investment guarantee fund or deposit guarantee fund. Therefore, the invested capital is not covered by these funds.

Housers is neither a credit institution nor an investment services company nor does it supply financial advice, so nothing on this website should be interpreted as such. The information on this page is for general information purposes only and does not constitute specific advice.

The participatory financing projects published on the website are not subject to authorisation or supervision by the Comisión Nacional del Mercado de Valores or the Bank of Spain or any other national or foreign regulator. The information provided by the developer has not been reviewed by the CNMV and does not constitute a prospectus approved by the CNMV.

The developer of the project is responsible to investors for the information it has provided to the crowdfunding platform for publication within the project on the website. The information shown has been prepared by Housers based on available information provided by the developer. Neither Housers nor its collaborating companies or suppliers accept responsibility or liability concerning the accuracy or sufficiency of the information referred to in the project. The statements or declarations with future projections refer exclusively to the date on which they were expressed, they do not form any guarantee of future results.

Both the financing aim and the maximum term to invest in this opportunity may be extended by an added 25% to the initially planned term, following Law 5/2015, of 27 April, on the promotion of business financing. Likewise, Housers will be able to close the financing of this opportunity/project when it has been 90% financed. These possibilities that the legislation offers to the platform will be used when the typology and characteristics of the project make it advisable so that the execution deadlines are not prejudiced. You can find more information here.

Before investing in this project, the investor must know the risks of his investment: Housers recommends carefully reading the Basic Information for the Investor.

In compliance with art. 61 of Law 5/2015 on the Promotion of Entrepreneurial Financing, Housers proceeds to inform the investor of the risks that he/she will run by investing in this project:

• Risk of total or partial loss of the invested capital: the main risk associated with any type of investment is the total or partial loss of the money invested, as well as the probability that the return obtained, will be lower than expected or estimated. In general, the higher the return on an investment, the higher the risk.

• Risk of not obtaining the expected financial return: there is no such thing as a safe investment. There is always a risk of losing everything invested or of not obtaining the expected financial return. Investments are based on future expectations that may not necessarily be realized, so the expected financial return on the investment may never occur or may occur differently than expected.

• Operational risk: failures or problems in systems, people or operational flows can have a significant impact on the investment. In any activity in any market, there is always an operational risk.

• Inflation risk: the possibility of rising inflation may cause the return on investment to decline due to the inevitable loss in the value of money in such circumstances.

• Risk of Lack of liquidity: investing in this project may mean that the investor may not be able to dispose of the money invested when needed, having to pay attention to the estimated timeframe for the liquidity of the investment and obtaining the corresponding return.

• Risk of not being able to influence the management of the developer: investors, as borrowers, like any other person outside a commercial company, have no right to influence the management of the developer or its assets unless this is provided for in the investment contract, and the investment contract may influence the developer's management of the developer.

• Fraud risk: as in any other economic operation, there is a risk of fraud due to improper use of the money obtained for the project. To minimize this risk, the drawdowns of the loan amount that are delivered to the developer will be made using a company external to Housers that will check the progress of the project, making the drawdowns to the developer according to a calendar of drawdowns and after administratively verifying the fulfilment of each earlier milestone of the calendar. The amounts of the loan not drawn down by the developer while waiting to reach the next milestone of the drawdown calendar will always be in the Housers Account of the developer in the payment entity used by the platform ("Lemonway") until the developer requests the drawdown, which will be authorized by the monitoring company if the developer meets the requirements established by the monitoring company.

The invested capital is not guaranteed by the investment guarantee fund or the deposit guarantee fund.

Investment in real estate should be conducted as a diversification strategy of a larger portfolio, and investment in projects published on the Housers platform is not recommended for people who do not have sufficient knowledge to understand the risks of investing in projects published by the crowdfunding platform.